What is a Reserve Study, Really?

December 14, 2018 / by HOA Manager

The slightly technical definition of a reserve study is: a budgeting tool based on the art and science of anticipating and preparing for major common area repairs and replacement expenses an association will face in the future.

3 Options if You Need to Make a Big Repair NOW in Your Association

December 7, 2018 / by HOA Manager

As a general practice, what does an HOA board do if there’s a problem in the association that exists right now, but not enough money in the reserves to fix it? Is issuing a special assessment the way to go, or can the board use other funds in the reserves?

What Percentage of Reserve Funding is Considered Healthy for an HOA?

November 30, 2018 / by HOA Manager

There are differing viewpoints when it comes to percentage funding of the reserves. Just going on percent funded can be misleading because that number fluctuates over time and is different for each homeowner’s association.

Can the Reserves Be Adjusted for Items Costing More Than Planned For?

November 19, 2018 / by HOA Manager

Picture yourself in this scenario: The clubhouse needs a new water heater and it will cost $10,000. But all prior reserve studies that have been done in the association have only allocated $6,000 for replacement. What are the board’s options to make up the additional $4,000 difference?

Can a Board Use Reserves for an Item Not Listed in the Reserve Study?

September 21, 2018 / by HOA Manager

The purpose of the reserve fund is to plan for future repairs and replacements in the association. But what about components that you can’t see and aren’t listed in the reserve study? For example, plumbing supply lines that aren’t included in the reserve study and will end up costing somewhere in the ballpark of $50,000 to repair or replace.

When Misguided Attempts to Keep HOA Fees Low Affect the Reserve Fund

August 1, 2018 / by HOA Manager

The reserve fund of a homeowners association is often misunderstood by members and sometimes the HOA board as well. Some see it as a slush fund that is to be used on a "rainy day"' when the association gets low on cash in the operating account. Others, although they may understand the need to have some measure of reserve cash, do not make the connection that reserve funds are being reserved for the particular components within the community that the association is responsible for, such as roads, roofing, siding, fencing, painting, and equipment replacement.

Why It's Crucial to Regularly Collect for Reserves at Your Homeowners Association

May 11, 2018 / by HOA Manager

Reserve funds are not an extra expense. They are part of the ongoing expenses of the homeowners association which occur at various points in time. The plan provided by your reserve fund specialist will help you in this process. It's much more preferable that homeowners associations have a plan to set the funds aside now, on a year-by-year basis. By doing this, the Association can spread out the collection of assessments for these expenses more evenly over the coming years.

Reserve funds are not an extra expense. They are part of the ongoing expenses of the homeowners association which occur at various points in time. The plan provided by your reserve fund specialist will help you in this process. It's much more preferable that homeowners associations have a plan to set the funds aside now, on a year-by-year basis. By doing this, the Association can spread out the collection of assessments for these expenses more evenly over the coming years.

There are other important reasons that Association monies should be put into reserves every month:

How Many Years Should an HOA Reserve Study Cover?

April 25, 2018 / by HOA Manager

So, your homeowners association is contemplating doing a reserve fund study. Perhaps you are a new HOA and need to establish and start funding the reserves; or, you are an older HOA that has had a reserve for years, but it is time to update it. How many years should your HOA reserve study cover?

Well, it depends. HOA communities vary in size, age and the number and dollar value of the capital assets they own. They choose different maintenance strategies for short-lived and longer-lived capital assets. Let’s explore some of these issues.

The Legacy of Your HOA Board: Passing the Torch

April 20, 2018 / by HOA Expert

When a new HOA board is transitioning into power, having solid foundations for the new members is important to the homeowners association’s success. The first step in a successful HOA board’s transition process is to set expectations, particularly if you have many board members (along with their experience) leaving the board. To do so, a comprehensive transition plan document should be in place. If there isn’t one, meet with current and new board members to document a plan. It’s a worthwhile investment, because the document can be used for future HOA board transitions.

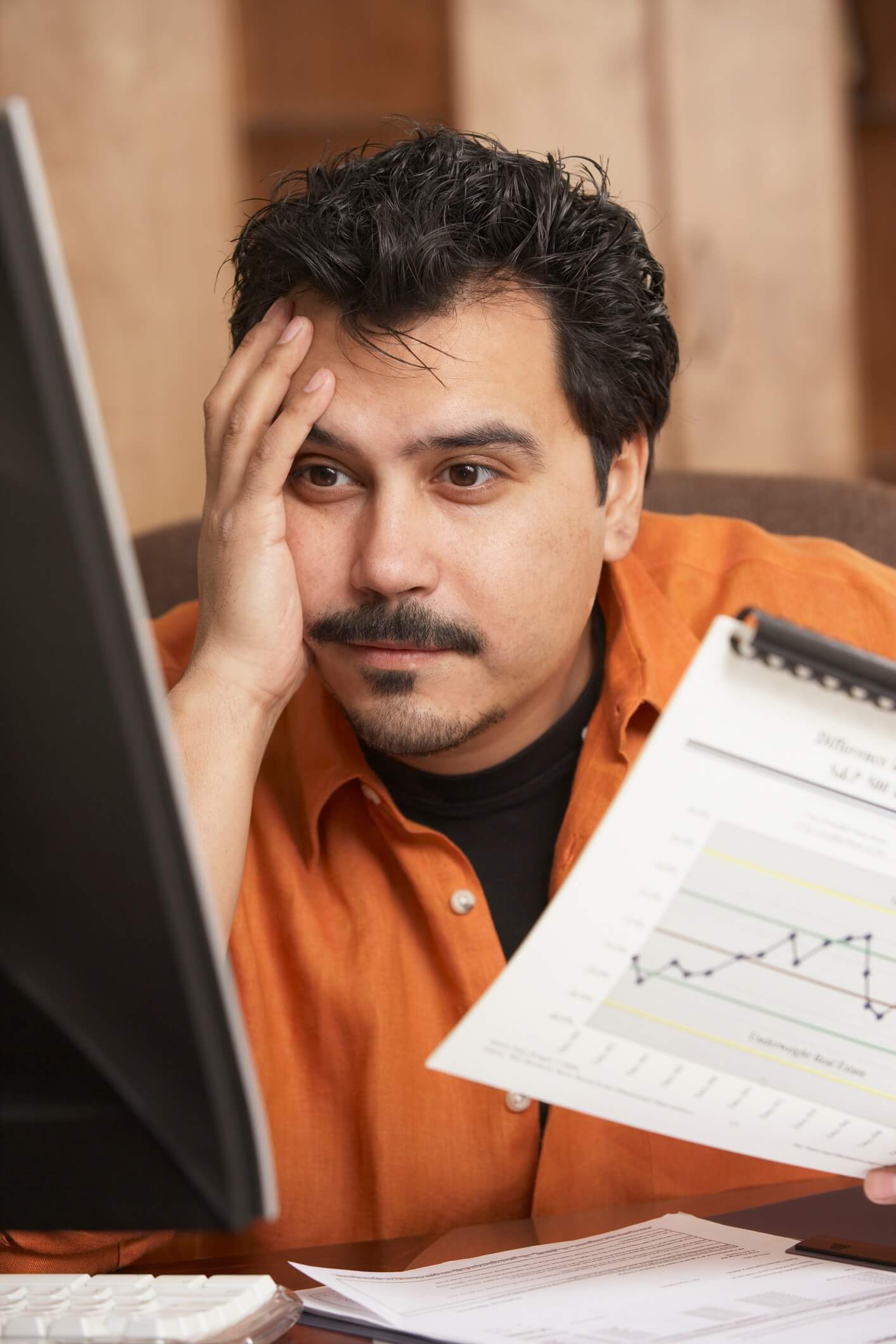

How To Interpret Your HOA Reserve Study

April 11, 2018 / by HOA Expert

More often than not, sitting down to review your HOA Reserve Study can be about as easy-to-understand and enjoyable as sitting down to review the U.S. Tax Code. And just reviewing your HOA Reserve Study is not enough. As an HOA Board member, you’re responsible for using that HOA Reserve Study to plan for, allocate, adjust, and collect reserve funds accordingly.

Here are some ideas to help you interpret your HOA Reserve Study and put it to good use so that your HOA can pay for what your community needs to keep it in good repair, easy on the wallet, and lovely to live in...today and in the future.

Why Your HOA Board Should Use a Reserve Specialist

April 4, 2018 / by HOA Manager

As an HOA board member you probably know what a reserve study is and the importance of doing one. If you don’t, take a couple of minutes to read this blog to familiarize yourself with frequently asked questions about doing a reserve study in your homeowners association.

Eliminate the Risks of Not Having Adequate HOA Reserve Funds

February 21, 2018 / by HOA Manager

The risks of not having enough HOA reserve funds for your community are as serious as the risks of not having enough emergency savings for your family. Imagine needing to pay for college tuition increases or costly medical expenses without having enough money set aside to do so. Now imagine fellow homeowners having their family budgets crushed by emergency assessments because there aren't enough HOA reserve funds for repairs. They’ll likely call you as a board member to complain!

Why not avoid these situations altogether? Having HOA reserve funds readily available “just in case” offers you and your fellow homeowners financial peace of mind.